Life is Beautiful

Imagine for a moment you are out for a ride on a beautiful summer day doing a little shopping. Meanwhile, your family is waiting at home , anxiously looking forward to your return. However, on your way home, A tragic accident occurs that quickly turns that joy into deep mourning. The mourning is especially worse since you have not yet signed up for that term life insurance policy you had been considering. Their mourning is worsened because in addition to the grief they are suffering, they face financial problems since you had not taken care of securing them properly . You are not there to feed your family & take care of them. That is why it is essential that you should start your term life insurance retirement planning now and get the right coverage for you and your family.

Tragic car accident

What is term life insurance ?

What are the disadvantages of term life insurance ?

Why is term life insurance so important?

For whom is worth a term life insurance ? And for whom is it not worth it ?

For how long you actually need term life insurance ?

What my sum insured should be?

Must examine me a doctor? What is then examined ?

Can I cancel a term life insurance ?

Can I increase or decrease the posts for my term life insurance later ?

Are there any risk life insurance a premium refund ?

Does the combination with a supplementary accident insurance make sense?

Can be combined with a term life insurance, disability insurance ?

Do my dependents pay to the payment of term life insurance inheritance ?

Why are smokers otherwise classified as Non smoking or pipe smoker ?

Not be term life insurance as collateral for the mortgage lending for too long

Where then is the risk?

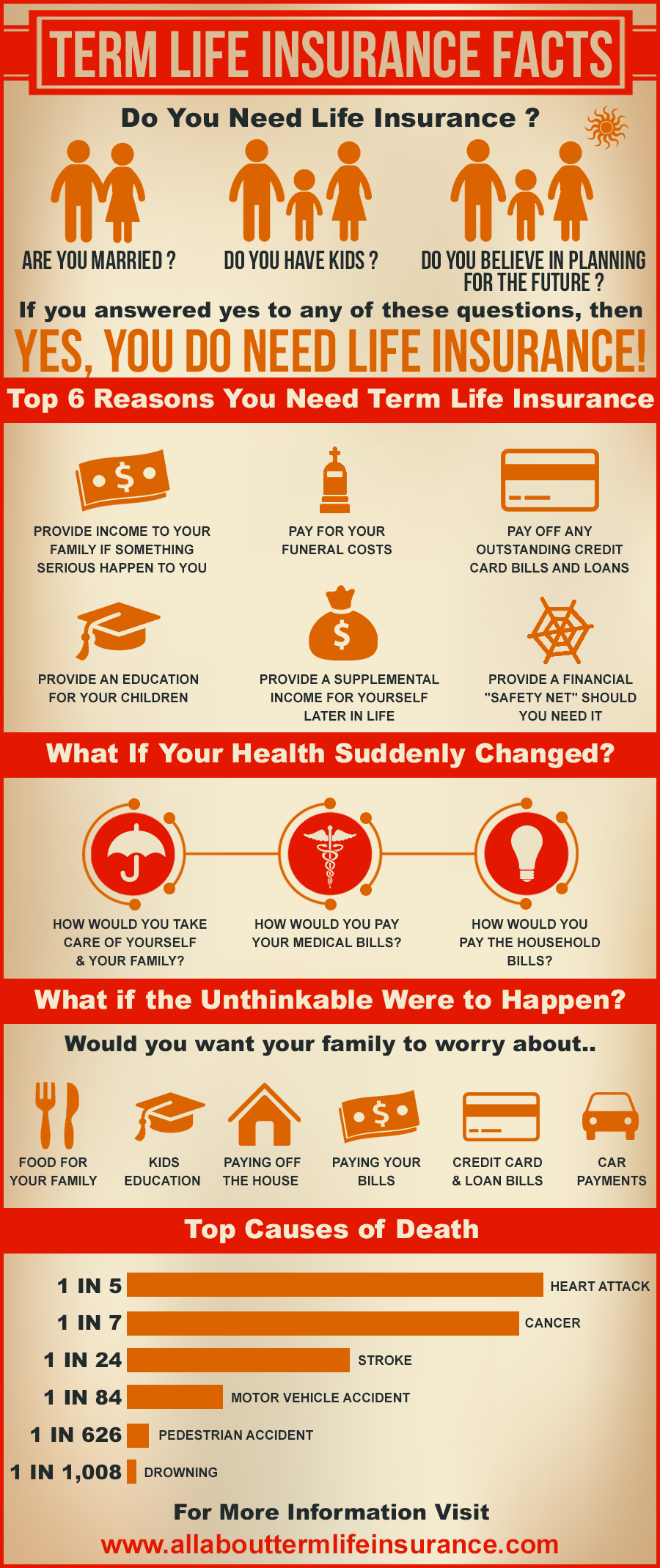

Term Life Insurance InfoGraphic

Term life insurance (aka Term Life Assurance) is a way for you to secure your family financially in the event of death. Thus, your survivors will not experience financial hardships. Banks look favorably on owners of term life policies as they may use the term life insurance as collateral when the deceased had yet to pay off a loan. The risk is transferred from the insured to the insurance company itself, which must pay the agreed sum insured even if the insured dies already shortly after entering into the insurance contract.

We all live with risk. Some of us however lead riskier lives than others. For example, what types of sports do you participate in ? Some sports are riskier than other. What about your lifestyle ? Do you Smoke ? The term life insurance company will perform checks before the execution of the contract on the policyholder in question to see whether or not their lifestyle requires adjustment in the premiums paid on the policy. Very seldom will a company deny insurance, instead, they will adjust the amount you have to pay. The more risk factors you trigger, the higher your premiums will be.

What are some of the characteristics of a term life insurance policy ?

- The surviving dependents are financially secure

- Collateral for loans in case of death

- Payout even with short-term deposit

glossary / explanation of terms

The contribution to be paid monthly or annually amount

Police certificate of insurance

Premium The contribution of insurance is also referred to as premium.

It is composed of a cost and a risk portion .

What are the benefits of term life insurance ?

Each insurance company has a special meaning . The term life insurance is one also included. Its purpose is also their biggest advantage because so you can protect your family to make it as well protected in the worst case to know. This is the most important point and should come first when the policy . In addition to ensuring the bereaved term life insurance for the policyholder has further advantages that should not be disregarded .

In case of death your family will be protected financially by the life insurance risk .

Who will be covered?

If you at the bank has a loan, then it also benefits them to secure your family through the term life insurance. One can thus ensure just that no one has to suffer from financial problems , but if one dies unexpectedly. The family has to bear not only the funeral expenses and running costs after the death . Since they can not even do that she has to wear the current credit at a bank in addition . The term life insurance jumps exactly one here and takes over the failure rates.

Further advantages

The contributions of a term life insurance are also suitable for small Portemonai Another advantage of term life insurance is that the contributions are very low and you can already partially complete for only € 50.00 a .

The amount , however, depends also on the agreed sum insured and may whichever be higher. Despite the small contributions, the sum insured is comparatively very high.

Therefore, less well-paid can take the power of term life insurance to complete.

Additionally, contributions to term life insurance from the tax can be deducted . They are simply listed under ” special editions ” . The policyholder may an individual sum and length of insurance arrange . The financing of a home is covered by the term life insurance.

Benefits at a glance

Protection of the bereaved

Supply of banks

Hedging of real estate financing

Contributions tax deductible

Flexible posts and maturities

Example Costs

Example Costs - Initial Annual Payment (Men)

Date of Birth | Non Smoking | Smoking |

|---|---|---|

| 4/15/1982 | 52.40 | 77.60 |

| 4/15/1972 | 87.20 | 186.00 |

| 4/15/1962 | 214.80 | 540.80 |

Example Costs - Initial Annual Payment (Female)

Date of Birth | Non Smoking | Smoking |

|---|---|---|

| 4/15/1982 | 35.60 | 54.00 |

| 4/15/1972 | 64.80 | 129.60 |

| 4/15/1962 | 143.20 | 333.20 |

* Such contributions are meant to be exemplary and are subject to the following requirements: Classic RLV . Insurance span 10 years , Sum insured: € 10,000 annual payment , dynamics 3 %, without BU- protection and additional protection for accidental death .

Example of a term life insurance calculator:

Note: This is not a real calculator for calculating a term life insurance. The computer is used only for demonstration purposes , as can the effects of different factors on the term life insurance premium.

My Age: years

I am

I smoke:

My annual contribution € 27.50

Now secure >

What are the disadvantages of term life insurance ?

Besides the advantages of term life insurance has advantages and disadvantages. You should weigh the pros and cons of insurance carefully and think about whether you want the really complete . In the first place probably is for the policyholder ‘s performance monthly or annual contributions to the term life insurance if you want to achieve the protection of his family. The insured enters into a binding contract and is planning a certain insurance term of the insurance . A one-time payment is also possible , but then it turns out much higher.

Security for your family with a term life insurance

Bound to the term life insurance

With the completion of a term life insurance policyholders forms a strong bond to the insurer. The period of insurance term life insurance is usually at least twelve years. When one announces the term life insurance before the policy term , you get back only a fairly low cash surrender value. In addition to the bond , one should remember that it itself has nothing of the money when you die. The hedging of the sum insured is paid to the bereaved. Contributions can be very high also , depending on lifestyle. This can happen if you have to professionally carry a high risk. In addition, most insurance companies do not pay the sum insured if the insured dies by suicide .

No payout on maturity

Term life insurance with maturation usually handle the insurance it so that there is no power at the end of the insurance period . If so ends the term of the insurance , the insurance companies reserve an accumulated amount in the rule. This can be prevented by modifications of the insurance by completing a term life insurance with a savings option . Then the term life insurance is treated as a savings account , which is paid at the end.

Disadvantages at a glance:

The contributions are no longer available .

Conclusion of a binding contract

Minimum terms

Low surrender value in case of early termination

Rare performance at suicide

After expiry of the period of insurance usually no payout

Maturities contract period

years

minimum 3

maximum 45

* Such contributions are to be understood as average values . Depending on the insurance deviations may incur .

Why is term life insurance so important ?

Many insurance companies ask for some people, a red cloth dar. You pay a monthly or annual contributions , of which there is actually nothing in the short term . In addition, matter itself is often very complicated. Many are thus uncertain and save their money rather the old way . The problem here is that the term life insurance in case of death pays an amount that you can not or very difficult to save up during this time. The financial crisis has also not essential to promote confidence in the insurance and banking . Nevertheless, the policyholder should deal with useful insurance. The term life insurance is an insurance policy that is particularly useful. Even if you have an aversion to insurance, you should view at least the term life insurance exactly . Because term life insurance can be a big help in the worst case.

Term life insurance is very important for the Protection and security of your family!

We keep hearing that term life insurance is especially important for families. But why is it so important? If the insured has a family , he wants that she is well cared for. This applies also and especially if he should die unexpectedly. Because then the family would without insurance are facing a big mountain of debt and do not know how they will pay him. The term life insurance pays an agreed sum insured if the insured dies before the expiry of the insurance period . This insurance helps the family to bear all the costs that have to do with the funeral and other factors. Just the primary wage earner should penetrate to worry about what happens when he is no longer there once. The insurance is one thing: security. This is still well taken care of even after the death of the family breadwinner for protection.

Security for the surviving family

Arguments for term life insurance

Protection of the family

The loan will be paid off

It ensures even after the death of his loved ones

Not all insurance companies are bad

Who has the advantages of term life insurance ?

Participating advantage

Policyholder Clear Conscience

Family Financial

Insurance Tradable capital , low risk

Banks balance at credit

For whom is worth a term life insurance ? And for whom is it not worth it ?

Many insurance companies advertise that they are needed. But everyone should decide for himself whether he really needed the insurance. A policyholder always has the freedom to choose whether they want to opt for one or the other insurance. This also applies for insurance. There are people who should take out a term life insurance in any case. For this term life insurance is incredibly important and is in the worst case, the rescue indebted for a family that needs care alone for their maintenance . Other people , in turn, do not need term life insurance. For these people it is totally unnecessary and can safely be ignored .

House under water

For whom is the term life insurance worth it?

Primarily, term life insurance pays for families with children. Right here it is important to take out insurance . Because if the insured dies before the expiry of the insurance period , the family gets paid the sum insured .

No problems , thanks to the term life insurance A family is always facing financial problems if the primary wage earner is no longer among the living .

She needs a good hedge .

The insurance provides as a hedge dar. Even if the insured can no longer pay for his family, he has nevertheless made sure that get the survivors by the sum insured no financial problems . This is true not only for the children. Even the parents of childless policyholder can pay the funeral expenses and the ongoing loans if the worst happens .

For whom is the term life insurance does not pay ?

The term life insurance is not worth it for people who have absolutely no family, which must be supplied after her death. Many insurance companies will try to offer even singles insurance. Trainees and students need as no insurance .

For whom is the RLV worth ?

main breadwinner

fathers

Who needs a term life insurance and who does not ?

YES | NO |

|---|---|

| Young families | Pupils |

| Single parents | Students |

| Large Families | Trainees |

| Main Breadwinner | Singles |

For how long do I actually need an insurance policy ?

The fact that a term life insurance is very important , is beyond question. With term life insurance you have taken good care of his family, if the policyholder should something happen . Each term life insurance but concluded only for a certain period of time. After forming both the premium payment and the hedge . Timing is very important here . You have to know at what time you want the policy. But which is the right moment to complete as insurance? Is that not good?

The right time is important

The right time has to be chosen

After starting a family it remains longer exist as the insurance period usually lasts. If you get a child and at the same time completes the term life insurance , this is usually extinguished after about twelve years. It is good if you by that time, died. To get the security maintained by the term life insurance, one further insurance following must then complete . The insurance period is then set new, as well as the insurance amount . To protect the family a permanent protection is always advisable by the term life insurance. In addition, there are other points in time , which always offer to be advisable.

Other important factors for the right time

As a young family , you should take out a term life insurance if you have just bought a house , then the funding must be secured . For term life insurance is best suited . This also applies in the event that you have to pay off a bigger loan .

So the family must in case of death not for the debts of the deceased liable and is well protected by the insurance sum .

But it ‘s not worth it to get the insurance to its natural end of his life upright . The money can then be better to invest in savings plans . It is important that the children have completed their own training and the property is fully paid. Then, also term life insurance is slowly superfluous.

How do I know the right time ?

Foundation of the family

Buying a property

marriage

borrowing

Right Time Wrong time

Marry divorce

Buying a property children finish education

Borrowing retirement age

Start their own training

What does one need when comparing a term life insurance pay ?

If you want to equip his family for each case with a hedge , you need one or the other insurance. A very good hedge in case of death , there are at the risk of life insurance. The policyholder pays low contributions and when he dies, the survivors get the insurance amount . But before one buys a policy , you should give some thought . This is particularly true for the comparison of a term life insurance with another . The comparison itself is free on the Internet . Man enters his data and gets calculated the annual contribution . The sum insured is one of the data that you must supply .

Term life insurance

Many comparison websites, many insurance companies, and many types to choose from

The comparison portals on the net are constructed so that they contain a variety of insurance . If we add the contribution to the risk of life insurance , the cheapest deals are displayed at the top. It always pays to ask for term life insurance with multiple portals . Not every term life insurance is represented everywhere. With such an important decision you should take enough time to compare each insurance. In addition to performance and insurance value and duration are always different. The best studied is the insurance that will appear for your own life makes the most sense . This provides the best protection for your family is guaranteed and you can to relax and concentrate other things.

Pay attention not only on the price

Compare term life insurance well together.

With a term life insurance , it is primarily the contributions and the final sum, which are interesting. Supposedly favorable posts give the impression that this term life insurance is the best . But you should also be careful here , from which make up the posts . After all, you want to invest primarily in term life insurance and not in the insurer. Many insurance companies advertise high levels of excess shareholding of up to 15%, which supposedly reduces the contributions . These figures are very unrealistic and should be examined critically .

What factors should I consider when comparing ?

level of contributions

sum insured

period of insurance

Criteria for acceptance

Additional services and offers

What my sum insured should be?

It’s good to know that you did everything possible for his family to protect them . The term life insurance is a great help if the policyholder should be no more. With the sum of the survivors may pay the funeral and possibly finance the property. Upon completion of term life insurance you should think about what to make the security provided by the term life insurance. What is really needed ? The sum is one of the central points in the term life insurance. The amount of the sum determined, inter alia , the amount of contributions that must be paid . One should ask before the end of term life insurance information , which amounts are in fact realistic .

It can always happen – What and whom I want to protect ?

What is the sum insured at the risk of life insurance is to be real, you have to think before. This includes what and whom you want to protect . The insurance period must also be included in the calculation . If you have no big family, but would like to secure the purchase of a house , one should define X amount . In a family where the children are not yet large , sum Y should be chosen. The exact figures can get information directly from the insurance comparison . Use can also be a little play with the numbers. So you can find out how high the regular contributions must be in order to receive a certain sum . One should choose not to big numbers. For a small loan a smaller sum sufficient in term life insurance. That is why there is always a connection between what you want and securing the required amount of insurance .

How much is the insurance Summer should I have ?

Is there a guide ?

Some insurers say , the sum of term life insurance should be about three to five times the gross annual income of the policyholder. Depending on hedge this sum can also vary up or down .

How do I know the correct amount of insurance coverage ?

Value of the hedged property

Financial family situation

own income

Own will to the level of contributions

Low Medium High

Property x x

Small credit x

Young family x

A family without children x x

No major financial problems x

Must examine me a doctor? What is then examined ?

If you want to take out a term life insurance, there are certain requirements that you must meet . In addition, the level of contributions will also be made by the policyholder on lifestyle. An insurance also depends on the sex and age of the person. The term life insurance is calculated so that the insurance company must make any payment of the sum assured with high probability. Here also the health of the policyholder plays a major role. Would he get aware of a serious risk of , it can be excluded from the term life insurance. Alternatively, the contributions will be increased dramatically.

Medical examination for post determination

Must examine me a doctor?

Many insurance companies require a medical examination at the end of the term life insurance. This allows them to calculate the contributions and the risk better. Chronic diseases or massive consumption of cigarettes , for example, also help to ensure that the contributions to risk life insurance to be increased. The sum insured thereby increases rather rare. In some cases, the insured may also be rejected.

Many insurance companies have a health check just a questionnaire. Cheating should be here but not . If it turns out at the end of the period of insurance that you lied in answering the questions , the insurance company may also refuse to protect employees in the event of death and forfeited contributions . If you are not sure at some points , you can also allow a consultation with the treating physician. So the doctor will be released from his secrecy. The insurance can now look directly into the files to see if any serious illnesses or other circumstances militate against favorable posts or term life insurance as a whole.

What is being tested ?

Checklist at the doctor the whole answer to general questions about their own health . It is prompted for chronic diseases such as asthma, disabilities , etc. . Also , cigarette consumption is requested . Indulgence is a big minus , which can be very expensive term life insurance . Or you will be directly rejected and the protection of one’s family is gone.

What factors are part of the health examination ?

Indulgence (cigarettes, alcohol, etc. )

teething

Chronic diseases

Existing deadly diseases

Mental suffering

survey

RLV RLV suitable unsuitable

Healthy people smoking

Addiction Free people drinker

Psyhisch stable people Mentally unstable people

Seriously ill people

Can I cancel a term life insurance ?

It is good if you have completed a term life insurance. In the event of cases the family is thus all-round protection . But sometimes it can come over the years to unexpected incidents. Then you need money urgently and deliberately to terminate the term life insurance and waive the protection of the family with it. The insurance period is shortened and thus the previously agreed sum insured is not required. Is it really so easy to terminate an insurance policy ?

Term life insurance for unexpected incidents

Can I just cancel that?

In short : Basically, yes. One can term life insurance terminate in principle at any time. However, there are at the early termination of term life insurance to consider a few things . Finally, would you , that despite the termination money left and is not completely retained by the insurer. As a policyholder , you should always check with their insurance company over the prescribed period of insurance and the insurance sum . Not every insurance contract , the same conditions apply . That is why you should think in advance whether you actually complete the term life insurance and do not want to terminate prematurely.

Do I get back my posts?

Surrender value upon termination if the termination of the term life insurance expires the hedge , you get back the cash surrender value. The surrender value is often significantly lower than the amount that was already paid . The amount of the surrender value depends on the original agreements . Often insurers charge the policyholder a part of the sum insured as a cancellation fee . The charge arises from the cost of early termination of the insurance. In addition, the insurance company must accept a calculated damage if the insurance period is not quite achieved . Finally, the full amount of the term life insurance comes into existence only when one fully exploits the insurance period .

What should I consider when the termination of my term life insurance ?

No complete refund of contributions

There will be a cancellation fee due

No protection for the family more

Possible example:

Share cancellation fee share of contributions refunded

Termination after 2 years 25 % 60 %

Termination after 10 years 15 % 75 %

Can I increase or decrease the posts for my term life insurance later ?

When taking out a term life insurance contributions in accordance with the sum insured and the particular policyholder to be adjusted. It makes information about its state of health , living conditions and the desired sum insured and the insurance period .

The protection of the family is therefore dependent on several factors.

Over the years, but may change the lifestyle of the policyholder. This might also changes the risk of term life insurance. It can be a career change , or you start smoking at . These factors have personal and financial influence and should always be considered. If you take a short-term rather dangerous profession, the term life insurance should be adjusted accordingly .

So many questions

Can the posts be adjusted?

An insurance company has rarely something about it that you want to increase the contributions and thus the sum insured on account of new circumstances. Also an extension of the period of insurance is possible under certain circumstances. Finally, the insurance companies get more money and thus can continue to ensure the security of your family .

Contributions may be adjusted Shortening the period of insurance is still preferred to see . The period would be foreseeable and the term life insurance is more likely to assume that they do not have to go into power . But if you want to reduce the contributions each year because of the lower risk , many insurance companies provide cross . Because then they would get less and lower contributions by the insured .

Other reasons for the change of the contributions

When the children have completed their education , they stand on their own feet . Then such a tremendously large sum is no longer necessary . It is always useful to get information before the conclusion , allow this change of term life insurance that insurance. The term life insurance itself but can also change the contributions when economic changes or health changes require.

When can I change my contributions ?

altered health

Familial changes

Higher risk of life at work

New loans

Contributions increase or decrease ?

increase sinks

Worse health status qualification of children

High-risk profession less dangerous profession

Beginning of a hedonism end of a self-indulgence

Are there any risk life insurance a premium refund ?

If you want to take out a term life insurance , you have to be over many factors clear . In general, it is such that a term life insurance after the insurance period does not pay the sum insured , but it retains . Therefore , the level of contributions should be chosen so that it is not too much hurts when the money is simply gone. In the classical term life insurance there is usually no way to get back his contributions . But there is also the form of term life insurance, for which the contributions are tied to an endowment policy . Both options have something for themselves. In principle, however , one should not expect in the normal model of term life insurance with a premium refunds .

Premium refunds for term life insurance ?

Premium refunds or hedging ?

If one is still alive after the end of the insurance period , you really do not get his money back . The protection of the family is thus void . However, the contributions are for correspondingly low. That is the risk that must carry the insurance.